Boston Scientific announced today its Q1 2021 results, showing CRM up 7.4% from $437M last year to $467M. Neuromodulation also increased 3.5% from $191M last year to $198M.

Among its accomplishments related to AIMDs, it listed:

- Launched Vercise Genus™ Deep Brain Stimulation (DBS) System in the U.S. Additionally, the system is being used with the world’s first 16-channel directional leads—Cartesia™ X and HX leads—in the eXTend 3D Study in Europe.

- Commenced U.S. launch of the WaveWriter Alpha™ portfolio of spinal cord stimulator (SCS) systems, consisting of four full-body MR conditional, Bluetooth-enabled devices, new FAST paresthesia-free therapy and all supported by Cognita™ Solutions—a suite of digital tools that helps physicians and patients navigate the pain management journey.

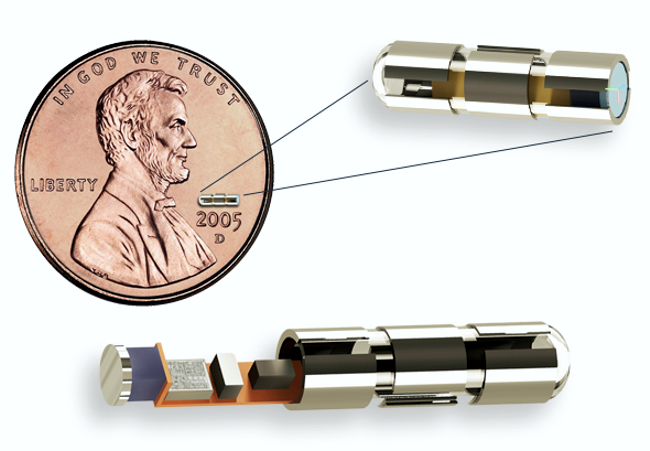

- Presented five-year outcomes from the EFFORTLESS study, the largest post-market registry of the Subcutaneous Implantable Defibrillator (S-ICD) System, further validating the long-term efficacy of the device. Results demonstrated 98% overall efficacy over five years, consistent with results of previous S-ICD studies and comparable to or higher than many large transvenous ICD studies.